WYOMISSING, PA (Jan. 29, 2020) – Penn National Gaming, Inc. (PENN: Nasdaq) (“Penn National” or the “Company”) announced today that it has entered into an agreement to acquire a 36% interest in Barstool Sports, Inc. (“Barstool Sports”), a leading digital sports media company, for approximately $163 million in cash and convertible preferred stock. Under the agreement, Penn National will be Barstool Sports’ exclusive gaming partner for up to 40 years and have the sole right to utilize the Barstool Sports brand for all of the Company’s online and retail sports betting and iCasino products.

- Barstool Sports Betting App

- Barstool Sports Betting App Release Date Today

- Sports Betting Websites Barstool

- Barstool Sports Betting Site

Barstool Sportsbook officially launched on September 18, going live in Pennsylvania. It will eventually be available in all states where Penn National has approved. The upcoming launch for Penn National‘s Barstool Sportsbook app will begin in Pennsylvania, with more states expected by the first quarter of 2021. That’s according to the company’s second-quarter earnings release, which saw Penn lose $79.3 million in adjusted EBITDA during the second quarter. Barstool Sportsbook mobile app launching in Michigan 19 January 2021 (PRESS RELEASE) - Penn National Gaming, Inc. Announced today that the Michigan Gaming Control Board has approved the Company’s applications to offer online sports wagering and iCasino products in Michigan. Release Date: March 19 This was one of those movies supposed to come out right as everything started shutting down last year, so it got shelvedtil now. I'm always skeptical about these Sony Pictures releases personally, but the trailer for this looked alright, and it's certainly a different kind of anti-hero they're workin with here, so I'll.

Jay Snowden, President and Chief Executive Officer of Penn National, commented, “This exciting new partnership with Barstool Sports reflects our strategy to continue evolving from the nation’s largest regional gaming operator, with 41 properties in 19 states, to a best-in-class omni-channel provider of retail and online gaming and sports betting entertainment.”

Mr. Snowden continued, “With its leading digital content, well-known brand and deep roots in sports betting, Barstool Sports is the ideal partner for Penn National and will enable us to attract a new, younger demographic, which will nicely complement our existing customer database. In addition, with 66 million monthly unique visitors, we believe the significant reach of Barstool Sports and loyalty of its audience will lead to meaningful reductions in customer acquisition and promotional costs for our sports betting and online products, significantly enhancing profitability and driving value for our shareholders.”

Jon Kaplowitz, Head of Penn Interactive, commented: “We look forward to introducing our 20 million mychoice customers to the Barstool Sportsbook brand through our retail sportsbooks and our interactive products. Our growing team of product and engineering talent at Penn Interactive is focused on what we anticipate will be a best-in-class sports betting app, which is expected to launch in the third quarter of 2020. Our team is excited to begin collaborating with Barstool Sports on ways to utilize its key talent and leading content to drive audiences to Penn National’s online gaming products and retail locations, as well as to special events and fan experiences.”

Erika Nardini, Chief Executive Officer of Barstool Sports, said, “Barstool Sports is a dynamic content company that has grown into a media juggernaut thanks to some of the best talent and fans in the world. Over the last five years, Barstool Sports has brought its audience, creativity and expertise to the biggest sports betting and DFS operators in the country with great results. The chance to combine our content and fans with Penn National's massive footprint, and to develop a unique and compelling omni-channel approach together, was for us a no brainer.”

Dave Portnoy, Founder of Barstool Sports, added, “This opportunity is a dream of mine and why I started Barstool Sports in the first place. Barstool Sports has a deep sports and gaming history and from the moment we met Jay and the Penn National team we knew this could be an exciting and game changing partnership and we can't wait to get started. I think with our shared vision and goals, we are uniquely positioned to be a leader in this business.”

Mike Kerns, Partner at TCG, stated, “We’re excited to partner with Penn National on Barstool Sports’ next chapter. We have long believed in the power of Barstool Sports’ unique brand, and with Erika’s leadership and Dave’s vision, the Company has realized remarkable growth over the last four years. We believe the marriage of the Barstool brand and passionate audience with Penn National’s gaming leadership will change the industry.”

Mr. Snowden concluded, “As we continue to execute on our omnichannel strategy, we plan to remain focused on our efforts to de-lever our balance sheet while building on our long-term progress in expanding operating margins at our regional casinos. As previously announced, our goal is to achieve a lease-adjusted net leverage level of 5.0x by the end of 2020.”

Transaction Details

Penn National’s initial investment for 36% of the equity of Barstool Sports is comprised of approximately $135 million in cash and $28 million in shares of non-voting convertible preferred stock. After three years, Penn National will increase its ownership to approximately 50% with an incremental investment of approximately $62 million, consistent with the implied valuation at the time of the initial purchase.

Under the terms of the agreement, Penn National has immediately exercisable call rights, and the existing Barstool Sports shareholders have put rights exercisable beginning three years from closing, for the remaining Barstool Sports shares based on a fair market value calculation to be performed at the time of exercise. Penn National also has the option to bring in another partner who would acquire a portion of Penn National’s shares of Barstool Sports. Penn National will have customary governance rights, including initially two seats on Barstool Sports’ seven-member board of directors.

Following the close of the transaction, entities affiliated with The Chernin Group, which previously owned approximately 60% of Barstool Sports, will own 36% of Barstool Sports, and the remaining 28% will be held by Barstool Sports’ employees, including Mr. Portnoy and Ms. Nardini.

The Company expects to close the transaction in the first quarter of 2020, subject to customary closing conditions set forth in the purchase agreement.

Penn National Gaming will host an analyst day in June to discuss the Barstool Sports transaction further and expand upon the Company’s omni-channel vision for the convergence of sports betting and casino gaming.

Conference Call and Webcast

Penn National will host a conference call and simultaneous webcast today, Wednesday, January 29, 2020 at 8:00 a.m. ET to review the Barstool Sports transaction, share the Company’s vision for sports betting and iGaming, and host a question and answer session. To access the conference call, interested parties may dial www.pngaming.com. During the conference call and webcast, management will review a presentation which can be accessed at www.pngaming.com. A webcast replay will be available for 90 days following the live event at www.pngaming.com. Please call five minutes in advance to ensure that you are connected. Questions and answers will be taken only from participants on the conference call. For the webcast, please allow 15 minutes to register, download and install any necessary software.

# # #

About Penn National Gaming

Penn National Gaming owns, operates or has ownership interests in gaming and racing facilities and video gaming terminal operations with a focus on slot machine entertainment. The Company operates 41 facilities in 19 jurisdictions. In total, Penn National Gaming’s facilities feature approximately 50,500 gaming machines, 1,300 table games and 8,800 hotel rooms. The Company also offers social online gaming through Penn Interactive and has a leading customer loyalty program with over five million active customers.

About Barstool Sports

Founded in 2003 by David Portnoy, Barstool Sports is a leading digital sports, entertainment and media platform that delivers original content across blogs, podcasts, radio, video and social, supported by nearly 70 dedicated personalities. It benefits from approximately 66 million monthly unique visitors, including an estimated 48% of males and 44% of females in the Millennial and Generation X generations across the United States. In 2019, Barstool Sports grew by approximately 65%, delivering nearly $100 million in revenue from digital and audio advertising, ecommerce, events, licensing and subscription.

Barstool Sports Betting App

About The Chernin Group

The Chernin Group was founded as a holding company to acquire and operate direct-to-consumer brands in media and tech. After a decade building consumer businesses, The Chernin Group management team formed TCG – a multi-stage investment firm based in Los Angeles and San Francisco. TCG’s portfolio includes digital media, commerce, marketplaces, sports, gaming, consumer finance, and health and wellness brands and platforms.

Forward-looking Statements

All statements included in this press release, other than historical information or statements of historical fact, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including statements regarding the Company’s investment in Barstool Sports and the related transactions, the Company’s online strategy, the potential benefits of the investment in Barstool Sports, including the benefits for the Company’s online and retail sports betting and iCasino products, the expected financial returns from the transaction with Barstool Sports, including reductions in customer acquisition and promotional costs, the projected closing date of the investment in Barstool Sports, the Company’s ability to repay debt in 2020, are subject to risks, uncertainties and changes in circumstances that could significantly affect the Company’s future financial results and business. Accordingly, Penn National cautions that the forward-looking statements contained herein are qualified by important factors that could cause actual results to differ materially from those reflected by such statements. Such factors include, but are not limited to: (a) the Company may not be able to achieve the expected financial returns due to fees, costs and taxes in connection with the Company’s roll out of its own online and retail sports books and iCasino products; (b) states may not pass legislation approving online and retail sports books and iCasino products; (c) the closing of the transaction with Barstool may be delayed or may not occur at all, for reasons beyond our control; (d) the ability to satisfy the closing conditions to the transaction in a timely basis or at all; (e) the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976; (f) potential adverse reactions or changes to business or regulatory relationships resulting from the announcement or completion of the transaction; (g) the outcome of any legal proceedings that may be instituted against the Company, Barstool Sports or their respective directors, officers or employees; (h) the ability of the Company or Barstool Sports to retain and hire key personnel; (i) the impact of new or changes in current laws, regulations, rules or other industry standards; (j) the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the Company and Barstool Sports to terminate any of the transaction agreements between the companies, and (j) other risks, including those as may be detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). For more information on the potential factors that could affect the Company’s financial results and business, review the Company’s filings with the SEC, including, but not limited to, its Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K. The Company does not intend to update publicly any forward-looking statements except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this press release may not occur.

CONTACTS:

General Media Inquiries:

Eric Schippers, Sr. Vice President, Public Affairs

Penn National Gaming

Kelly Martin, Head of Talent Relations and Communications

Barstool Sports

Kelly.Martin@barstoolsports.com

Financial Media and Analyst Inquiries:

Justin Sebastiano, Sr. Vice President of Finance and Treasurer

Penn National Gaming

Joseph N. Jaffoni, Richard Land

JCIR

212-835-8500 or penn@jcir.com

BofA Securities is out with an early, positive reaction to the Barstool Sportsbook app after its opening weekend in Pennsylvania.

The Penn National Analyst: Shaun Kelley reiterated a Buy rating on Penn National Gaming (NASDAQ: PENN) and raised the price target from $59.75 to $85.

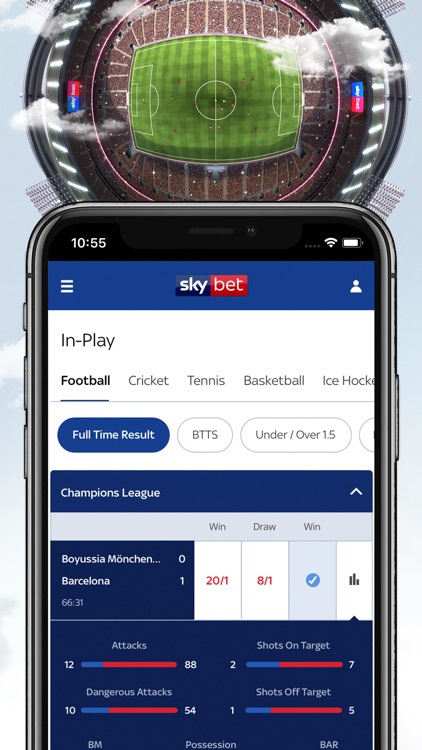

Barstool Sportsbook: The Barstool Sportsbook app was the No. 1 sports betting app and the No. 1 sports app in the Apple Inc. (NASDAQ: AAPL) App Store during the company’s weekend launch. Barstool founder Dave Portnoy took to Twitter to show off the No. 1 spot for the app.

“Our initial impressions are positive given the app’s ease of use and leverage of the Barstool brand to create a unique interactive experience,” BofA's Kelley said in a Monday note. “We think the app targets more of a casual bettor than competitors.”

In its first two days of availability, the Barstool Sports app was downloaded 29,000 times. That is four times higher than the number of downloads that FanDuel and DraftKings Inc (NASDAQ: DKNG) saw after their launch, the analyst said.

The Barstool Sportsbook app was downloaded 23,000 times on Saturday, which is higher than any single day for rivals FanDuel and DraftKings, he said.

The app maintains a 4.9-star rating, making it the top-rated sportsbook.

“Penn’s ability to drive conversion from downloads to deposits and deposits to bets/revenue is the next critical step,” Kelley said.

BofA's Penn National Price Target: The increased price target comes from the initial success of the Barstool app and the rise in DraftKings shares, the analyst said.

“We roll forward to 2022 estimates and assign a higher multiple to sports and iGaming following the recent move higher in DraftKings,” the analyst said.

BofA's price target is based on a 12x EV/EBITDA multiple on estimated 2022 earnings and 8.5x revenue on sports betting/iGaming.

“Most consumer growth stocks trade at double digit EBITDA multiples,” Kelley said. “Factor in Penn’s leverage, small size, retail base, momentum and short interest and it's easier for us to see additional upside.”

PENN Price Action: Shares of Penn National were trading down 0.55% at $70.21 at last check Monday.

The stock hit a new 52-week high last week of $76.62 ahead of the Barstool Sportsbook launch.

Barstool Sports Betting App Release Date Today

Courtesy photo.

Latest Ratings for PENN

Sports Betting Websites Barstool

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Sep 2020 | B of A Securities | Maintains | Buy | |

| Sep 2020 | Rosenblatt | Initiates Coverage On | Buy | |

| Sep 2020 | Bank of America | Reiterates | Buy |

Barstool Sports Betting Site

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.