DHFL fixed deposit score on many points as compared to other fixed deposits with banks. It offers you higher returns along with more security and safety. It is a customized and specially designed to meet the different requirements of different customers. Please find herewith Public Announcement regarding Insolvency resolution process of DHFL (Dewan Housing Finance). According to this, all deposit holders (FD Holders only) (Matured or to be mature) has to submit their claim with insolvency professionals by 17 Dec’2019.

Table of Contents

- 1 About DHFL Aashray Deposit

- 1.1 Advantages of DHFL Fixed Deposit

Dhfl Fixed Deposit Premature Withdrawal

About DHFL Aashray Deposit

Dhfl Fixed Deposit Form

DHFL fixed deposit score on many points as compared to other fixed deposits with banks. It offers you higher returns along with more security and safety. It is a customized and specially designed to meet the different requirements of different customers. This Aashray fixed deposit is available for the different tenure ranging from 12 months to 120 months. The maximum rate of interest for the fixed deposit amount is up to 8.00% per annum. It also provides free insurance cover of ₹1 lakh to individual depositors in case of single deposit account and every first depositor in case of joint deposit account.

Advantages of DHFL Fixed Deposit

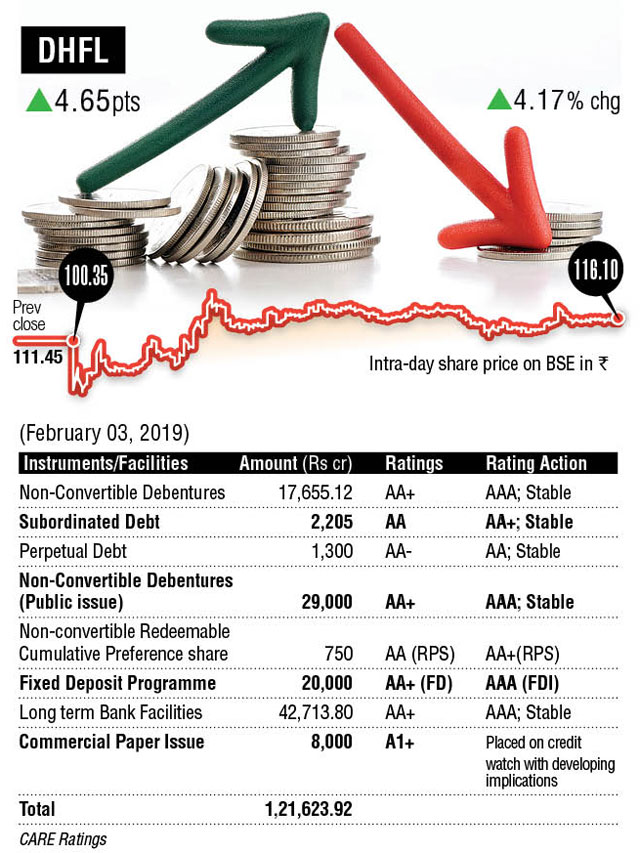

- It is rated as AAA (FD) by CARE and BWR FAAA by Brickworks and assure the highest degree of safety

- Available with a minimum investment of ₹10,000 only

- Additional interest of 0.25% for senior citizens

- Additional interest of 0.25% for senior citizens, widows, armed forces personnel, DHFL Home Loan/SME Loan/Mortgage borrowers

- Facility to avail loan against FD of up to 75% of the FD amount

- It also offers free accidental death insurance of ₹1 lac to the individual depositor and every first depositor.

- Safe, secure earning of short/medium/long-term investment

- Liquid investments

- Prompt and timely payments

- ECS facility for internet payments

- Hassle free process

Fixed deposit renewal policy

Fixed deposit will be renewed from the maturity date at prevailing rates on the said date if renewal request is received within 6 months of the maturity date. If the renewal request is received after 6 months of the maturity of fixed deposit, the company will not pay the interest for the interim period between the date of maturity and date of renewal.

Dhfl Fixed Deposit Status

Dhfl Fixed Deposit Rating

Amount Below ₹50 lakhs

Dhfl Fixed Deposit Schemes

| Non-cumulative | ||||||

|---|---|---|---|---|---|---|

| Tenure | Minimum Deposit | Cumulative | ||||

| Monthly | Quarterly | Half-yearly | Yearly | |||

| 12 | ₹ 2,000 | 7.75% | 7.40% | 7.75% | 7.55% | 7.75% |

| 14 | ₹ 10,000 | 7.80% | 7.45% | 7.80% | 7.60% | 7.80% |

| 24 | ₹ 2,000 | 7.80% | 7.45% | 7.80% | 7.60% | 7.80% |

| 36 | ₹ 2,000 | 7.85% | 7.50% | 7.85% | 7.65% | 7.85% |

| 40 | ₹ 2,000 | 7.90% | 7.55% | 7.90% | 7.70% | 7.90% |

| 48-120 | ₹ 2,000 | 8.00% | 7.65% | 8.00% | 7.80% | 8.00% |